The Relationship Between Tax and Audit

While tax and audit are distinct concepts, they are interconnected. Audits can help identify potential tax liabilities or errors, ensuring that businesses and individuals pay the correct taxes. Additionally, accurate financial statements verified through audits are essential for preparing and filing tax returns.

Importance of Taxes

Paying taxes is a legal obligation for both individuals and businesses. Proper tax management ensures compliance with the law and avoids penalties or fines. Businesses also benefit from strategic tax planning, which can minimize tax liabilities and improve financial performance.

Failing to comply with tax obligations can lead to serious consequences, including audits by tax authorities, legal actions, and hefty penalties.

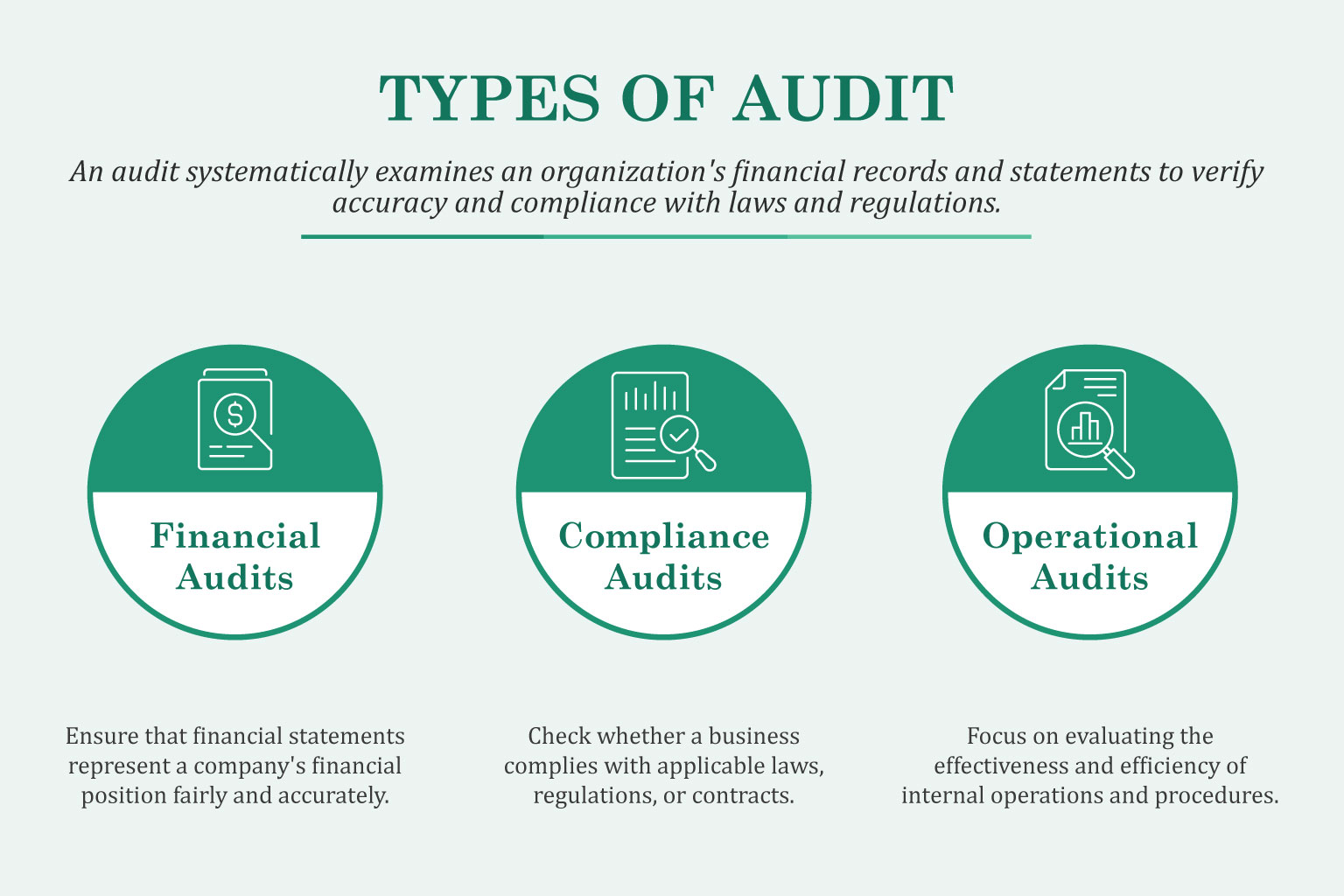

Importance of Audits

Audits play a crucial role in building trust with stakeholders, investors, and regulatory authorities. They help ensure that a company’s financial statements are accurate, reliable, and compliant with the law. Regular audits can also identify inefficiencies, fraud, or errors in economic systems, allowing businesses to correct issues and improve operations.

Audits are mandatory for publicly listed companies and are required by law to protect investors and ensure transparency in financial reporting.

How Taxes and Audits Interact

Although taxes and audits have different purposes, they often intersect. For example, if a business’s tax returns raise red flags, tax authorities may initiate an audit to investigate the accuracy of the submitted financial information. In this context, the audit focuses specifically on verifying the correctness of tax filings.

Additionally, financial audits often examine tax liabilities and payments as part of the overall review, ensuring that all tax-related entries in the financial statements are accurate and compliant with the law.

Key Tax Considerations for Businesses and Individuals in Bangladesh

Bangladesh has a well-defined tax structure that applies to individuals, businesses, and corporations. Understanding the tax regulations is crucial for maintaining compliance and avoiding penalties. The tax system in Bangladesh is administered by the National Board of Revenue (NBR) and includes various types of taxes, such as income tax, value-added tax (VAT), and customs duties.

1. Income Tax for Individuals and Businesses

In Bangladesh, individuals and businesses are required to file income tax returns annually. The tax rates for individuals are progressive, meaning that the rate increases as income levels rise. For corporations, the tax rate depends on the type of company:

Publicly traded companies: Generally taxed at a lower rate to encourage stock market participation.

Non-publicly traded companies: Taxed at a higher rate.

Banks, insurance companies, and financial institutions: Subject to sector-specific tax rates.

Taxpayers are also entitled to certain deductions and rebates based on their investment in savings instruments, education, and health expenditures.

2. Value-Added Tax (VAT)

VAT is a consumption tax levied on the sale of goods and services in Bangladesh. The standard VAT rate is 15%, although different sectors may have varying rates. Businesses with an annual turnover exceeding the government-specified threshold must register for VAT and submit periodic returns.

VAT plays a critical role in the Bangladeshi tax system, and businesses must comply with proper invoicing, record-keeping, and reporting obligations.

3. Corporate Tax

Corporate tax in Bangladesh is based on the type of business entity and its activities. Companies must pay corporate taxes on their profits, and tax rates can differ based on sectors such as manufacturing, IT services, and export-oriented businesses. Exporters enjoy reduced tax rates, especially those in the readymade garments (RMG) sector, to encourage international trade.

Several incentives are available for businesses in certain sectors, including tax holidays for new companies in industries like IT, power generation, and infrastructure development.

4. Withholding Tax

Bangladesh uses a withholding tax system, where taxes are deducted at the source on various types of income, including salaries, dividends, and contractor payments. Employers must withhold income tax from their employees’ salaries and remit it to the NBR.

For international transactions, a withholding tax is applied to payments made to non-residents for services such as consultancy, technology, and professional fees.

5. Double Taxation Avoidance

Bangladesh has signed agreements with various countries to avoid double taxation on income earned abroad. These treaties allow businesses and individuals to avoid being taxed twice on the same income in both Bangladesh and another country. This is especially important for Bangladeshi companies with international operations and expatriates.

6. Tax Filing and Compliance

All individuals and businesses in Bangladesh must file tax returns by the designated due date. Failure to comply with tax filing requirements can result in penalties, interest on unpaid taxes, or legal action. Businesses must maintain accurate records of all transactions and expenses to ensure compliance during audits.

Tax evasion and non-compliance are considered serious offenses in Bangladesh, and the NBR conducts regular audits to ensure that all taxpayers meet their obligations. Digital tax filing systems have been introduced to streamline the process and encourage compliance.

7. Tax Incentives for Special Economic Zones (SEZ)

Bangladesh has established special economic zones (SEZs) to attract foreign direct investment (FDI). Businesses operating within SEZs enjoy tax holidays, exemptions on import duties, and other incentives to encourage industrial growth and export production. These zones offer significant tax advantages for companies expanding their operations in Bangladesh.

Understanding the tax system in Bangladesh is critical for businesses and individuals to avoid legal issues and take advantage of available tax incentives. By maintaining compliance with the NBR’s regulations and staying informed about changes in tax policy, taxpayers can optimize their financial management and growth strategies.